Navigating Different Stages of AI in Accounts and Finance Tech

Artificial intelligence is slowly becoming indispensable in every part of the business. Accounting and finance are no exception, with AI revolutionizing basic processes. Typically, there are seven stages of AI that can seamlessly enhance the finance industry. However, navigating the complex AI jargon can be confusing. Let’s dive into the seven stages with their practical application in accounting.

Rule-Based AI: Automating Repetitive And Mundane Tasks

Rule-based AI or Repetitive Machines is the most fundamental stage of AI. Its objective is to automate and simplify repetitive and mundane business tasks with the help of pre-defined rules. For instance, an AI-enabled software or virtual assistant can handle data entry, process invoices, detect discrepancies, handle account reconciliations, and generate financial reports. Hence, this stage can automate basic accounting tasks without any hassles.

Reinforcement Learning: Taking Experiential Learning To The Next Level

This stage explores one step ahead of automation. The primary objective of reinforcement learning is to imbibe the ability to learn from previous or past experiences. For instance, an AI system forecasts business growth or challenges based on historical financial data. Additionally, this stage also learns to adapt itself as the data evolves. Imagine fraud detection models adapting to every suspicious activity over time.

Machine Perception: Interpreting The World Through Data

The third stages of AI is to understand the world with the help of data from multiple sources. It tries to attain human-like intelligence and go beyond analysis and automation. Some examples are language processing and image recognition. Imagine software that helps detect critical information from contracts without any manual intervention.

Artificial General Intelligence: Solving Complex Real-Life Problems

In this stage, AI possesses superior human-like intelligence capable of solving complex real-world problems. Also known as Strong AI, General AI may seem highly futuristic. However, it is inching toward reality with higher creativity, adaptability, and problem-solving skills. Imagine a platform catering personalized financial advice in a matter of a few clicks or handling investment portfolios with accuracy.

Conscious AI: Imaginative Future Where Machines Have Consciousness

Conscious AI: Imaginative Future Where Machines Have Consciousness

The stage five of AI is straight out of science fiction. It envisions machines with self-awareness or consciousness of their own. Conscious AI’s potential is vast and highly debated with its practical application. It can revolutionize the financial industry with its thought process. Such AI can regulate, analyze, and monitor financial markets without breakdowns.

Superintelligence: Machines Surpassing Human Capabilities

This stage is purely hypothetical at this point. However, superintelligence can soon become a grave reality. In this, machines surpass human capabilities in all aspects. Hence, its potential can be far-reaching and beyond human imagination. For instance, in the future, AI can predict economic slowdowns and recessions and construct a financial infrastructure superior to human understanding.

Augmented Intelligence: Human-AI Collaboration For A Better Future

It is the most optimistic vision of AI and human collaboration. Rather than focusing on AI as a threat and competition, it envisions it as a supportive partner for a mutually beneficial future. Hence, machine-human symbiosis can lead to profitable financial decisions by leveraging each other’s strengths. We can make informed decisions, considering technical and emotional aspects for optimal outcomes.

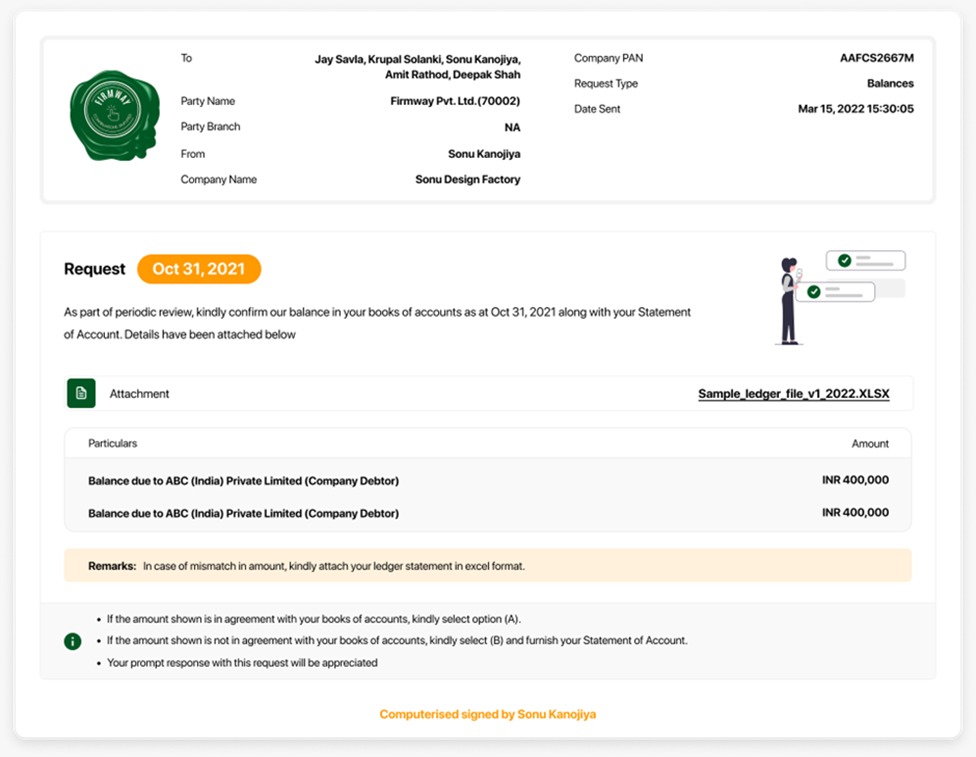

Navigating the Future With AI: Make Reconciliation And Confirmation Easier With Firmway

AI is an undeniable reality that will become indispensable to every business proces s. Even now, AI is simplifying various accounting and financial tasks. Firmway also leverages AI for efficient reconciliation and balance confirmations. Experience Firmway’s touchless platform and get Reconciliation done in less than sixty seconds or increase your customer response rate by two times with auto- follow-ups.

Conscious AI: Imaginative Future Where Machines Have Consciousness

Conscious AI: Imaginative Future Where Machines Have Consciousness

Financial Anchor: Bank Reconciliation To The Rescue

Financial Anchor: Bank Reconciliation To The Rescue