All About Digitized Balance & Audit Confirmation

A balance & audit confirmation letter is a crucial request sent to third parties in order to gather specific information regarding items that significantly impact the financial statement. Consequently, this process plays a pivotal role, as it aids in substantiating various assertions made in the financial statement, ultimately contributing to the formation of a well-informed opinion about its accuracy.

Importance of External Confirmation in Auditing

In the field of auditing, external confirmation, especially for financial elements like banks, loans, payables, receivables, and more, is a widely practiced method. To secure compliance and standardize the confirmation process, the Auditing and Assurance Standards Board (AASB) empowered by the Institute of Chartered Accountants of India (ICAI) issued SA 505: External confirmations. Further, to assist the professional accountants in implementing the confirmation process, ICAI issued the guidance notes that provide for obtaining confirmations for receivables, cash and bank balance, and liabilities.

Automating the Balance & Audit Confirmation Process

Conventionally, auditors use letters, posts, or emails to obtain confirmations from external parties. Click here for manual balance confirmation samples – negative or positive. However, it is not a sustainable solution for a high volume of accounts of large-scale businesses. Thus, there is a need for digital transformation. In this article, we will delve into the concept of digital balance confirmation letters. Additionally, digital transformation plays a crucial role in assisting auditors in automating tedious parts of audits. Furthermore, in the context of external confirmation, automation will not only lower clerical errors but also significantly enhance the efficacy of the audit evidence.

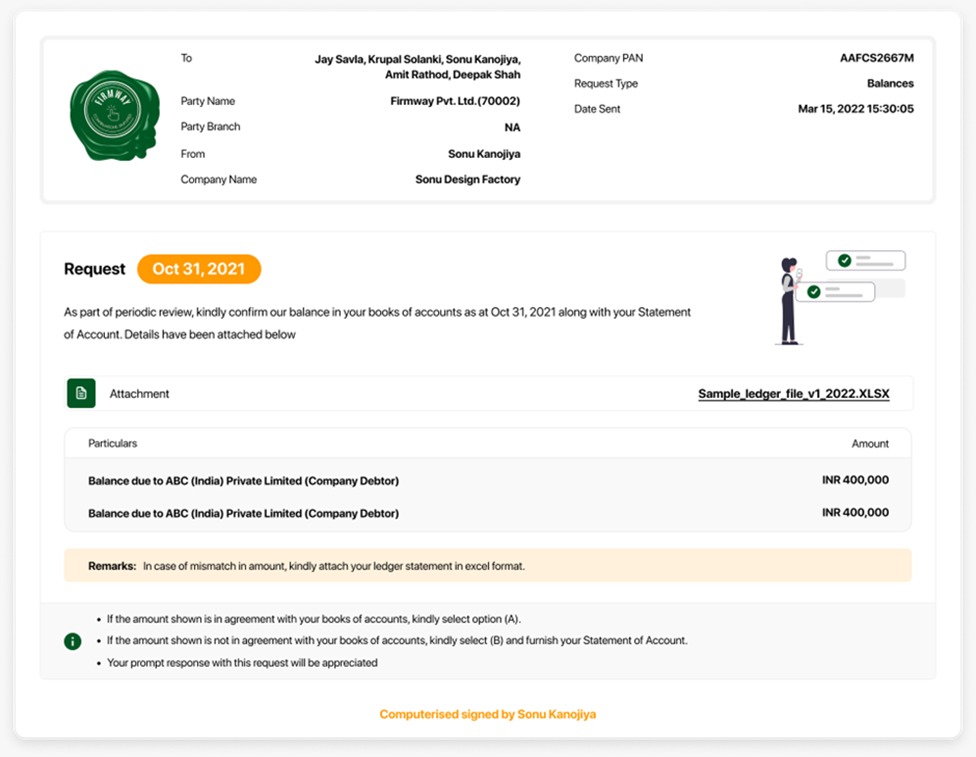

Streamlining Confirmation with Firmway

An affordable way to automate the external confirmation process involves the adoption of software such as Firmway. Furthermore, Firmway stands as India’s premier online software for balance confirmations. Leveraging cutting-edge technology, it streamlines and standardizes the process of obtaining external confirmations.

Effortless Responses

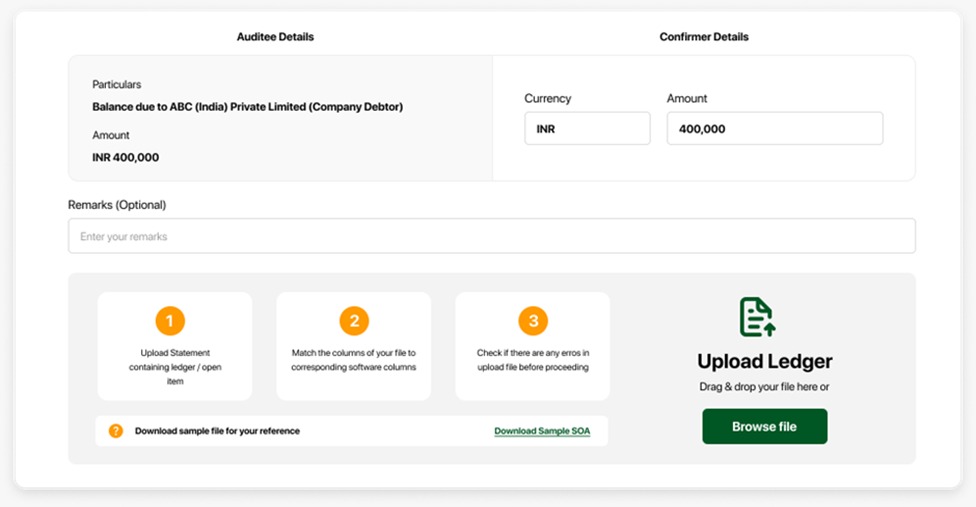

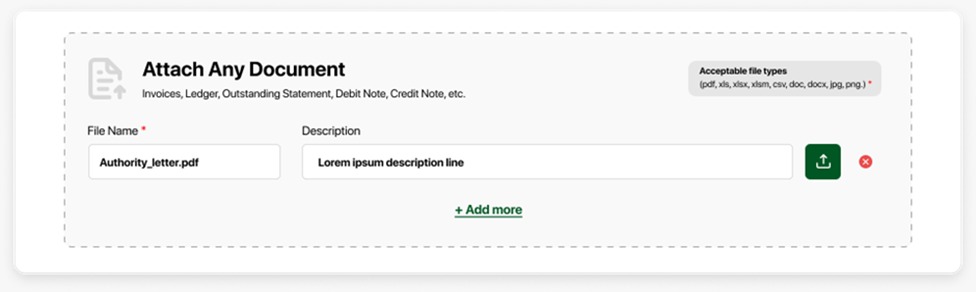

It allows auditors to efficiently process bulk requests and provides a comprehensive synopsis of reconciled and unreconciled balances. It allows debtors/creditors/banks to respond easily in the following ways:

1: Click on the unique link to respond & will be directed towards response sheet

2: Click on “amount is correct / incorrect” as per your deal (Only valid for positive & negative confirmation)

3: Incase of blank confirmation ask responding party to add the amount as per their books

4: Responses confirmed with auto-generated OTP verification shared on third party email id

5: Live Tracking of responses on dashboard for audit trail purpose

Leveraging Audit Automation Tools

In this way, audit automation tools make confirmation easier for third parties and resolve the issue of manual follow-ups, fewer responses, tracking the data, collecting & accumulating the data. All leading accounting and auditing firms are automating the labor-intensive part of the audit to focus on analytical work. Thus, it is high time to leverage technology to smoothen the audit process.