What Are The Roles and Responsibilities of Modern CFO ?

The changing dynamics of business pose newer challenges and CFOs now need to be more vigorous, effectual and adaptable. The Modern CFO need to have more than just technical knowledge. The roles and responsibilities of CFOs has changed from being just technical and finance experts to being a partner in the organization’s growth and prosperity. They can be the catalyst of growth and holds the power to change the entire trajectory of the organization. However, in essence, what is expected of the modern-day CFOs? Let’s find out!

Key Roles & Responsibilities of Modern CFO

Following are some of the modern day CFO roles and responsibilities that have become essential for any organization:

- Leveraging Technologies: Technology is essential for an organization’s survival, and failing to embrace it can doom the organization. Modern-day CFOs must monitor technological changes and determine how to evolve the organization with the latest technologies.

- Identifying Opportunities: As the business grows, more and more opportunities knock on the doors. By identifying the latest trends, networking, collaborating, encouraging innovations and adopting a proactive approach, CFOs can grasp the opportunities for overall growth and expansion.

- Risk Management: An organization faces multiple risks whether it’s from the environment, competitors or governmental policies. Now, the roles and responsibilities of CFOs also include the need to identify and assess major risks that are a threat to the organization and develop risk mitigation strategies. Further, CFO should also monitor the effectiveness of these strategies and keep track of the risk profile of the organization.

- Quality Decision-Making: Decision-making is one of the most important skills for any leader. At the top management level, the decisions that leaders make decide the fate of the organisation. Modern-day CFOs need to gather and analyze data and derive meaningful conclusions before making any decision.

- Managing Team: This begins right from building the team and training to equip them with the necessary skills and knowledge. CFOs play a key role in managing the finance team of the organisation. They establish goals, set directions and provide necessary guidance to the team to achieve their objectives. Further, they provide necessary feedback and support to ensure the growth of the team.

Modern CFO : In a Nutshell

Modern-day CFOs are expected to deliver more than just their finance roles. While expected to curate strategies and make informed financial decisions, CFOs have transformed their roles and responsibilities to be more inclusive towards the organization’s management. Thus, it is important for individuals to equip themselves with the necessary knowledge, understanding and experience to deliver maximum value to the organization.

Conclusion: Embrace the Cloud for Digital Transformation

Conclusion: Embrace the Cloud for Digital Transformation

Firmway’s MSME Confirmation Software

Firmway’s MSME Confirmation Software

Steps to Identify Struck-Off Company on MCA

Steps to Identify Struck-Off Company on MCA

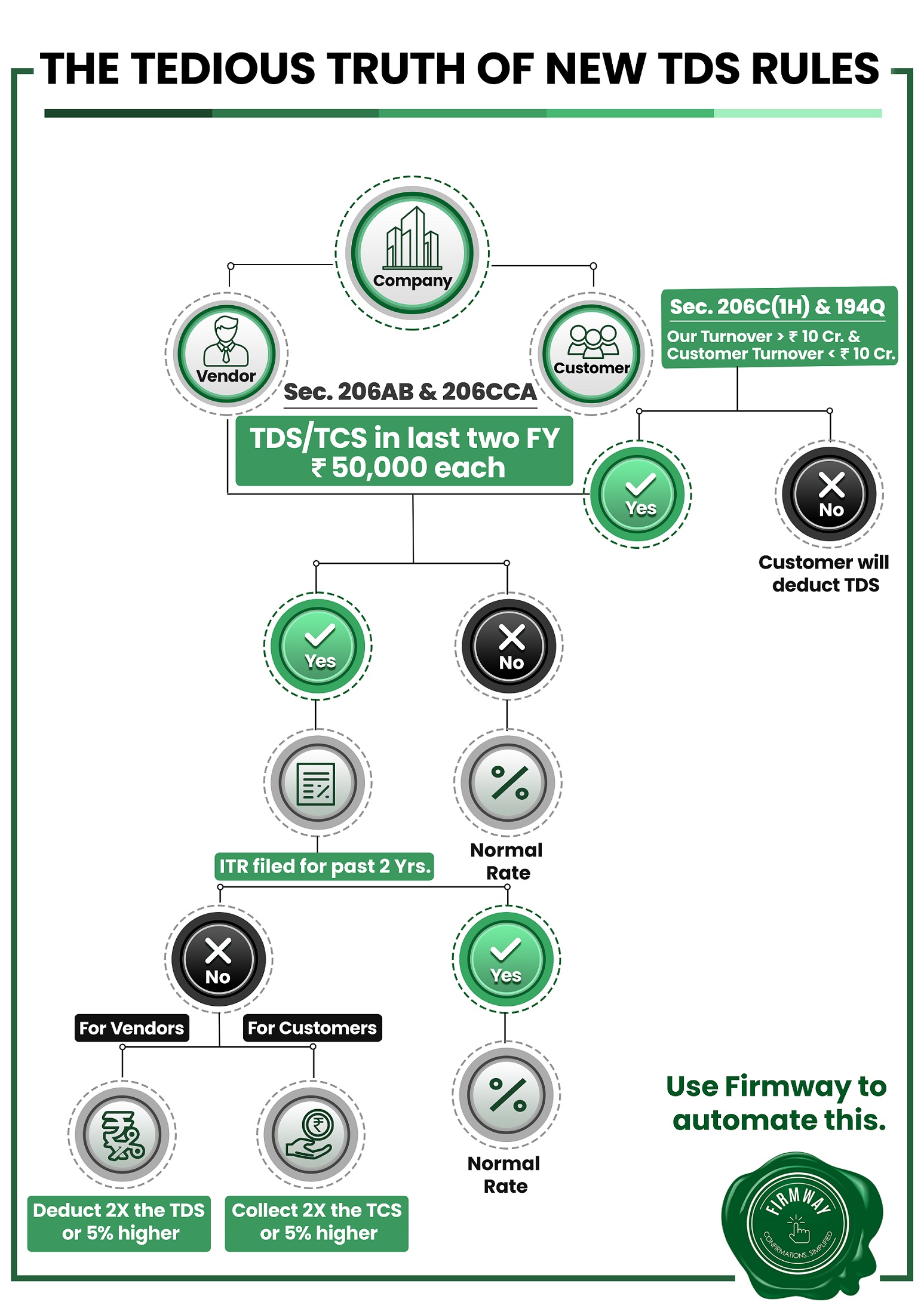

Tax Changes :-

Tax Changes :-