How Can Early Audit Benefits Improve Your Audit Process?”

Auditing is a critical process that ensures the accuracy and reliability of financial statements, essential for maintaining public trust and confidence in financial reporting. The auditor’s role is to examine the financial statements and provide an independent opinion on their accuracy and fairness. However, this process can be time-consuming and complex and auditors face various challenges during the audit process. To tackle this challenges starting the audit early brings Early Audit Benefits, such as better planning and flexibility, which improve the overall process.

Discover the Early Audit Benefits That Improve Accuracy

Starting audits early not only provides extra time for completing the same but also increases audit effectiveness. Here are some of the major benefits of starting audits early:

Effective Planning :-

The first and foremost reason why auditors should start their audits early is effective planning. It is the initial and crucial component of the audit process. Auditors must carefully plan the audit carefully to ensure that it is conducted effectively and efficiently. Starting the audit early provides the auditor with sufficient time to plan the audit effectively. This includes gathering all the necessary information and resources required for the audit, reviewing the previous year’s audit reports, and understanding the client’s business. With effective planning, the auditor can better understand the client’s business operations, identify any potential risks or issues, and determine the scope of the audit.

Early Detection of Issues :-

Starting the audit early provides auditors with sufficient time to identify and address issues that may arise during the audit process. Early detection offers an opportunity for auditors to investigate and resolve issues before they escalate into significant problems. For example, if auditors identify a potential fraud risk during the planning stage, they can thoroughly investigate it and develop appropriate audit procedures to address the risk.

Flexibility :-

Starting an audit early provides auditors with greater flexibility in scheduling. It allows auditors to work around the client’s schedule and address any unexpected issues that may arise during the audit process. For instance, if the client is unavailable during the scheduled audit period, auditors can adjust their schedule accordingly to ensure timely completion. Additionally, if unexpected issues arise during the audit process, auditors can adjust audit procedures to address them, which is easier with more time available.

Reduced Stress :-

Starting an audit early reduces stress for both auditors and clients. There is less pressure to complete the audit on time, reducing the likelihood of errors or oversights. If auditors start an audit too late, they may rush through procedures to meet the deadline, resulting in mistakes. This can cause stress for clients, worrying about the accuracy and completeness of their financial statements. By starting the audit early, auditors can avoid these issues and provide a more accurate and thorough audit report.

Improved Quality of the Audit :-

Starting an audit early improves the quality of the audit by allowing auditors to conduct a more thorough and comprehensive review of the client’s financial statements and accounting practices. With more time available, auditors can review financial statements and accounting records in more detail, leading to a more accurate and complete audit report. Additionally, auditors can perform more substantive testing to verify the accuracy of financial statements and identify potential errors or misstatements.

How Early Audit Benefits Can Make Your Audits Seamless

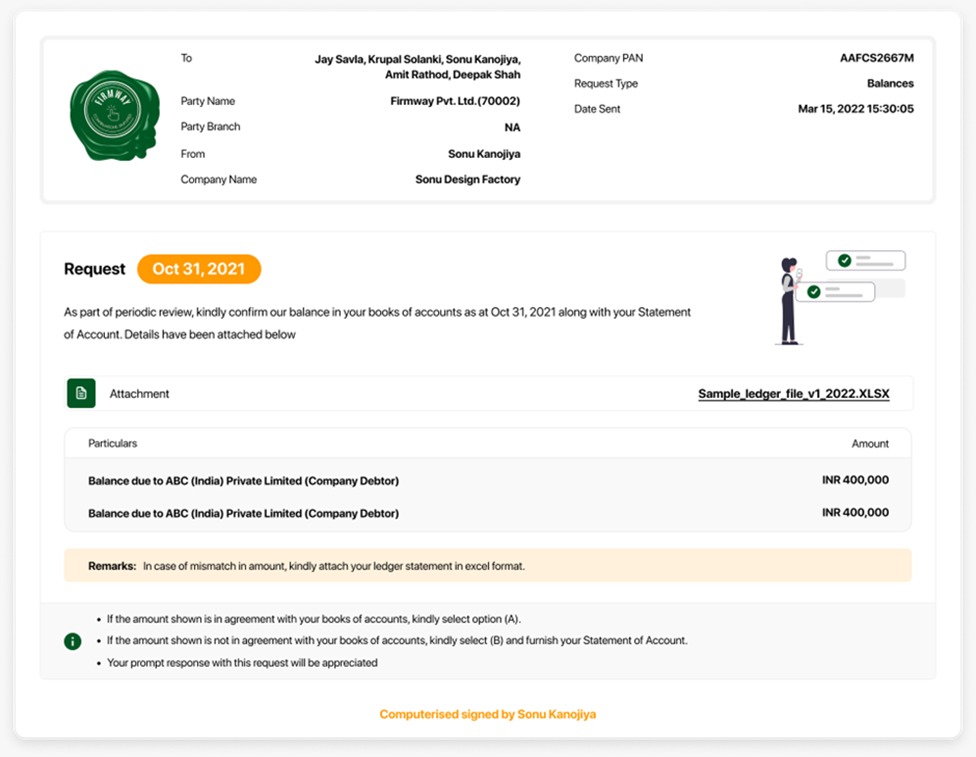

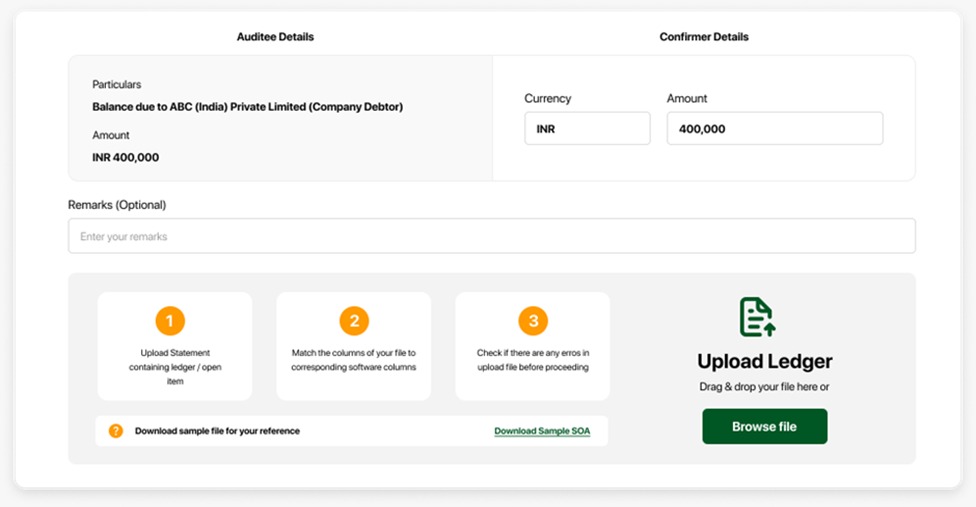

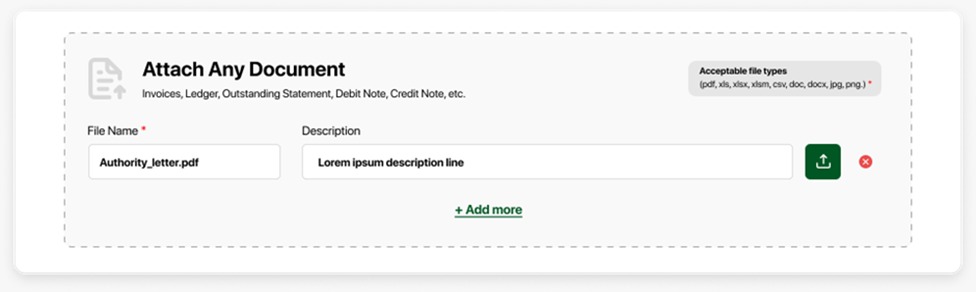

One of the most important functions of an audit is confirmation and reconciliation, which can be a cumbersome and time-consuming process. Automating these processes allows auditors to focus on essential elements of the audit. But how can both these processes be automated?

Auditors have been relying on Firmway for automating their Confirmation and Reconciliation processes. Firmway offers a useful, scientific, and comprehensive solution for External Confirmations. Becoming tech-savvy and conducting audits using the latest tools and software has become paramount for the effective, accurate, in-depth, and timely completion of audits. Firmway provides various modules like Balance Confirmations, MSME Confirmations, TDS Reconciliation, and purchase register reconciliation, etc., to seamlessly match the books with reported information and external parties. Are you auditing your clients with Firmway?

Enhance your audit process—start early and leverage Firmway’s Automation for a seamless and effective auditing experience.