GSTR-3B: Insights

The government has published the GSTR-3B format for filing #GST returns for the months July’17 and Aug’17.

Furthermore, to ensure a smooth rollout of GST and address industry concerns about return filing, authorities decided that businesses would pay taxes based on a simplified return (Form GSTR-3B) during the first two months of GST implementation. Additionally, this form includes a summary of both outward and inward supplies, which businesses must submit before the 20th of the following month.

Moreover, the GSTR-3B form simplifies the filing process. Registered persons must submit consolidated details in a simplified manner as notified.

Details to be furnished in Form GSTR-3B is as follows:

1. Outward and Inward Supplies

The tax filing form mandates that taxpayers report consolidated taxable values and tax amounts for both outward and inward supplies, including supplies liable under the Reverse Charge Mechanism (RCM). Additionally, it underscores the necessity of accurate reporting to maintain compliance with tax regulations. Furthermore, this reporting requirement ensures transparency in financial transactions and aids in preventing tax evasion.

2. Inter-State Supplies

Details of inter-state supplies made to unregistered persons, composition taxable persons, and those holding Unique Identification Numbers (UIN) must be reported in the GST return filing form applicable to such transactions.

3. Input Tax Credit

Eligible input tax credit can be claimed based on the transactions reported in GSTR-3B, subject to compliance with GST rules and conditions.

4. Exempt, Nil-rated, and Non-GST Inward Supplies

Accurate reporting of exempt, nil-rated, and non-GST inward supplies in GSTR-3B ensures compliance with GST regulations.

5. Payment of Tax and GST TDS/TCS Credit

The GST return form also requires taxpayers to provide details regarding the payment of tax and GST TDS/TCS credits, ensuring comprehensive reporting of financial transactions under GST.

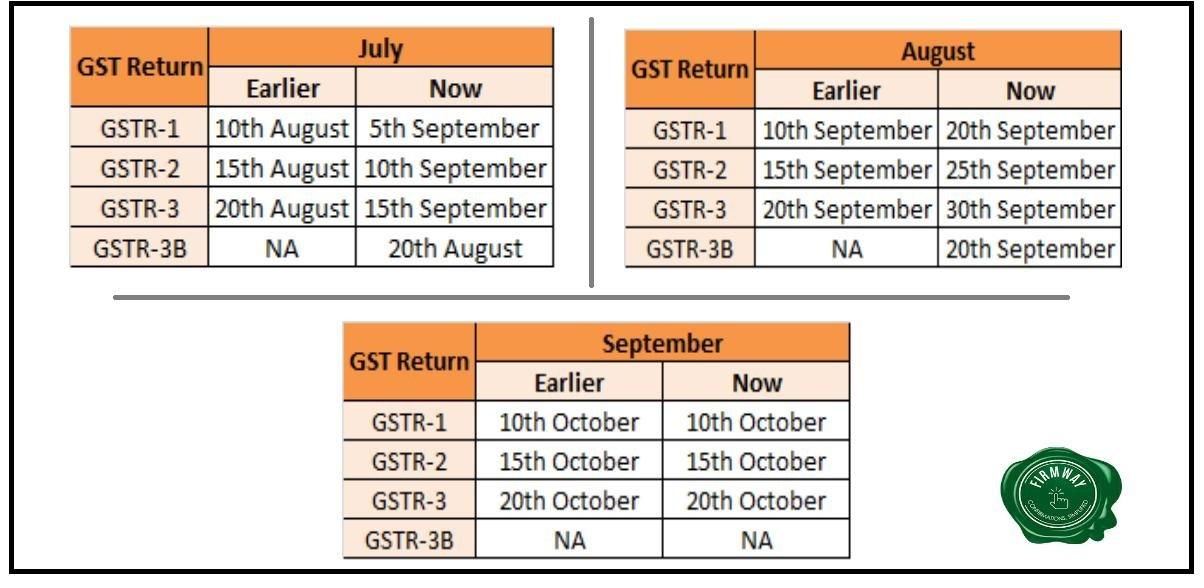

GST returns will have to be filed for the months of July and August 2017 as per the timeline given below:

Firmway’s Role in Assisting with GSTR-3B

Firmway assists businesses in aligning with vendors and customers, thereby ensuring timely filing of their first GST return within a week. As a result, this prevents unintentional interest costs, helping businesses maintain financial efficiency and compliance

Conclusion

[/vc_column_text][/vc_column][/vc_row]