Common Pitfalls of Manual Audit Confirmation

- Human Error: Manual audit confirmation processes are highly susceptible to human error. Errors can occur during data entry, sending out confirmation requests, or interpreting responses. These mistakes can lead to inaccurate confirmations, which may compromise the audit’s overall reliability and the accuracy of financial statements.

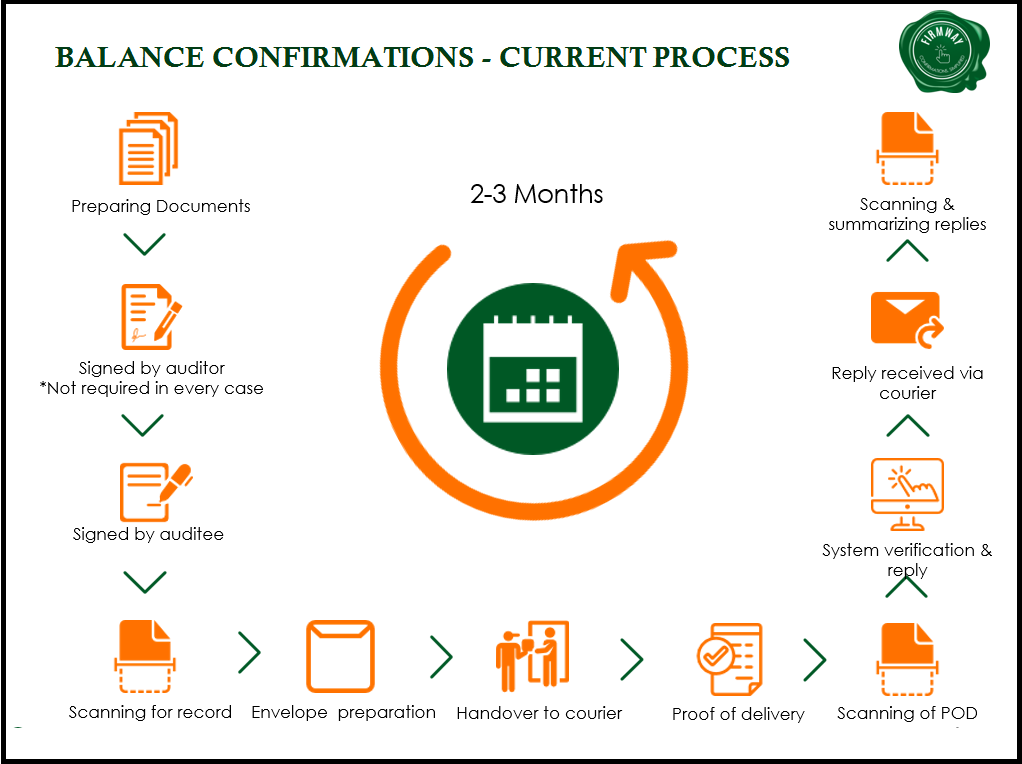

- Time-consuming and Inefficient: The manual process of obtaining audit confirmations is often slow and labor-intensive. It involves preparing confirmation requests, sending them out, tracking responses, and following up with non-respondents. This lengthy process can delay financial reporting and affect the timely completion of audits.

- Verification Difficulties: Verifying the identity of the confirmer is a critical aspect of the confirmation process. Manual methods often lack robust verification mechanisms, making it challenging to ensure that responses come from legitimate and authorized sources. This can increase the risk of fraud or misrepresentation.

- Inconsistent Follow-Ups: Follow-ups are essential to obtaining confirmations, but manual follow-up processes can be inconsistent and unreliable. This can result in incomplete confirmations and gaps in audit evidence, making it difficult for auditors to draw accurate conclusions.

- Data Security Concerns: Manual handling of sensitive financial information poses significant security risks. Physical documents are vulnerable to loss, theft, or damage, while electronic communications may be susceptible to unauthorized access. These risks are heightened in a manual setup, where security measures may be inadequate.

How Firmway’s Audit Confirmation Software Addresses These Pitfalls

Firmway’s audit confirmation software offers a comprehensive solution that addresses the challenges associated with manual methods. By automating and streamlining the confirmation process, Firmway enhances accuracy, efficiency, and security.

1. Enhanced Accuracy and Reduced Errors

Firmway’s software minimizes human error by automating data entry and processing. Moreover, the platform ensures that all confirmation requests are accurately prepared and sent. Additionally, responses are systematically recorded and analyzed. Consequently, this automation reduces the likelihood of mistakes and ensures that confirmations are reliable and accurate.

The software also includes built-in error-checking mechanisms that flag inconsistencies or potential issues. Consequently, auditors can address them promptly. Moreover, this level of accuracy is crucial for maintaining the credibility of financial reports and ensuring that audit conclusions are based on reliable evidence

2. Accelerated Confirmation Process

The traditional manual process of obtaining confirmations is often slow and cumbersome. However, Firmway’s automated platform significantly speeds up this process by streamlining workflows. Furthermore, it reduces the time required to obtain confirmations, thus enhancing overall efficiency.

Automated features include the ability to send bulk confirmation requests, track responses in real-time, and manage follow-ups efficiently. Consequently, this acceleration not only helps meet tight financial reporting deadlines but also enhances the overall efficiency of the audit process. Furthermore, by streamlining these tasks, your team can focus on more strategic aspects, ultimately improving overall productivity.

3. Robust Verification Mechanisms

Firmway’s software includes advanced verification features that ensure the legitimacy of the confirmer. The platform uses sophisticated algorithms and authentication methods to verify the identity of the responder, providing confidence that confirmations are received from authorized and legitimate sources.

This robust verification process helps reduce the risk of fraud and ensures that the confirmations obtained are valid and reliable. Additionally, it enhances the overall security of the confirmation process, thereby protecting sensitive financial information from unauthorized access. Furthermore, this approach reinforces the trustworthiness and integrity of the entire system.

4. Automated and Consistent Follow-Ups

Follow-up is a critical component of the audit confirmation process, particularly for obtaining responses from non-respondents. Firmway’s software automates follow-up communications, ensuring that all outstanding confirmations are pursued systematically and consistently.

The platform can schedule and send automated follow-up requests at predefined intervals, significantly improving response rates and reducing the likelihood of incomplete confirmations. This automation ensures that auditors receive the necessary evidence to support their conclusions and complete the audit effectively.

5. Enhanced Data Security

Data security is a top priority for Firmway’s audit confirmation software. The platform employs advanced security measures, including encryption and secure communication protocols, to protect sensitive financial information throughout the confirmation process.

By leveraging these security features, Firmway ensures that all data remains confidential and protected from unauthorized access. This enhanced security reduces the risk of data breaches and ensures that audit confirmations are handled with the highest level of security.

Types of Confirmations Supported by Firmway

Firmway’s software supports a wide range of audit confirmations, making it a versatile tool for auditors across various industries. The types of confirmations include:

- Debtor Confirmations: Verifies amounts owed by customers, ensuring that receivables are accurately reported in the financial statements.

- Creditor Confirmations: Confirms outstanding liabilities, providing assurance that payables are correctly stated.

- Loan Confirmations: Validates the existence and terms of loans, ensuring that both assets and liabilities are properly recorded.

- Stock Confirmations: Confirms stock levels and values, helping to verify inventory balances.

- Bank Balance Confirmations: Verifies cash and bank balances, ensuring that financial statements reflect accurate cash positions.

Why Choose Firmway’s Audit Confirmation?

Firmway’s audit confirmation software offers a modern solution to the challenges of manual confirmation processes. By automating and enhancing the confirmation process, Firmway provides a more reliable, efficient, and secure alternative that meets the needs of today’s auditors and organizations.

Choosing Firmway means embracing a smarter approach to audit confirmations—one that reduces risks, improves efficiency, and enhances the credibility of financial reports. With Firmway, auditors can confidently conduct their work, knowing that they have a powerful tool to support their efforts.

To experience the benefits of Firmway’s audit confirmation software, register here: https://app.firmway.in/register

Firmway helps to enhance the credibility of financials, detect and prevent frauds to uphold the interests of the various stakeholders.

Confirmations being an important source of authentication for the various stakeholders, the various flaws associated with the manual process had to be mitigated. To ensure a flawless and effortless process of obtaining confirmations, an effective and proficient platform was obligatory—this led to the birth of FIRMWAY. The unique verification process makes it the best way of obtaining confirmations.

Types of confirmations taken:

- Debtor

- Creditor

- Loan

- Stock

- Bank Balance

Firmway sends the Confirmation, Verifies the Confirmer, carries out regular follow-ups with the Confirmer and Summarizes Responses.

To Register please click here: https://app.firmway.in/register

Steps to Identify Struck-Off Company on MCA

Steps to Identify Struck-Off Company on MCA

Steps to Identify Struck-Off Company on MCA

Steps to Identify Struck-Off Company on MCA

How AI is Revolutionizing the Audit Industry :-

How AI is Revolutionizing the Audit Industry :-

Tax Changes :-

Tax Changes :- Illustrative Balance Confirmation Letter to be Sent to Debtors Negative Form

Illustrative Balance Confirmation Letter to be Sent to Debtors Negative Form

How do we do it?

How do we do it?

The Daunting Task of Manual Balance Confirmations

The Daunting Task of Manual Balance Confirmations